| Yomiuri Shimbun Staff Writer |

| December 19, 2011 |

| By Mamoru Kurihara |

|

|

|

|

Samples of rare earth alloys produced in Baotou |

China's curbs on exports of rare earths, which are essential for manufacturing high-tech products, are being felt more and more by Japanese manufacturers.

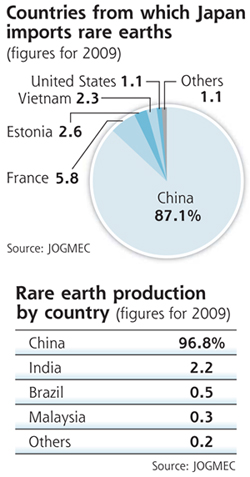

China has a near monopoly in the global production of rare earths, and the Inner Mongolia Autonomous Region of China produces most of the country's rare earths. One city in the region, Baotou, which has a population of about 2.7 million, calls itself "a city of rare earths."

The city hosts 75 related companies, including China's biggest rare earth-producing firm, Baotou Iron & Steel (Group) Co. Numerous luxury cars and skyscrapers can be seen in the city, which at night is bathed in light from neon signs.

The autonomous region is home to Bayan Obo mine, the world's largest rare earth mine.

The area was once known as a production center of such rare earths as neodymium, which is essential for the manufacture of small magnets for motors.

However, the Chinese government has strictly limited production of rare earths in the area since 2008, citing such reasons as environmental protection.

As a result, industrial complexes of material-processing companies that use rare earths have been struggling to procure supplies.

An Sihu, assistance director of the Administration Committee of the Baotou National Rare-Earth Hi-Tech Industrial Development Zone, said, "We have stopped production because mining companies are unable to meet environmental standards. Their facilities will be improved in a year or two to meet the standards."

An's statement suggests the committee has no plans to soon increase production at the mine. Our request to visit the mine was rejected.

Japan's Showa Denko group has a rare earth materials processing plant in the region.

Prices of rare earths are now higher than silver, said Takahito Moriya, president of the group's Chinese arm. Silver is priced at about 80,000 yen per kilogram.

"In this plant, they [rare earths] are stored separately under strict watch to prevent theft," he said.

Chinese rare earths were once said to be "cheaper than Chinese cabbages," and the low prices effectively ended production in the United States, Australia and other countries.

When Chinese rare earths came to dominate the global market, the Chinese government curbed exports of what it calls "strategic natural resources." As a result, rare earth prices surged.

"Supplies of rare earths will likely be secured for some time because inventories bought for speculation will be released," a Japanese rare earth wholesaler said.

In 2009, Japan imported 87 percent of its rare earth imports from China. As China continues to curb exports of the key ma- terials, Japanese companies are struggling to take countermeasures.

This autumn, Mitsubishi Electric Corp. announced it would raise prices of new models of air conditioners, and Panasonic Corp. hiked prices for its fluorescent lights.

Industrial analysts said production of electric vehicles and hybrid vehicles will also be affected.

For now, Japanese manufacturers using rare earths are depending on their inventories. An official of a major trading company said, "Early next year, Japanese makers will be running short [of rare earth inventory]."

But rare earth prices began falling this summer.

An official of Japan Oil, Gas and Metals National Corporation said, "Japanese companies' efforts to reduce rare earth use have been effective."

President Carlos Ghosn of Nissan Motor Co., which leads the auto industry in the field of electric vehicles, said in October countries other than China would expand production of rare earths.

He said this would stabilize prices of rare earths at reasonable levels.

Even so, the stable procurement of rare earths will certainly continue to be a headache for Japanese companies, whose competitiveness has been weakened partly by the extreme rise in the yen's value.